Selling puts on margin

For Reg T the shortcut. Ad Gain access to the Nasdaq-100 Index at 1100th the notional value.

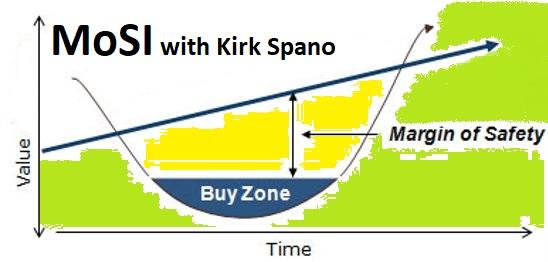

Printing Money Selling Puts Seeking Alpha

Cash secured puts use options collateral which you do not pay interest on with Robinhood so they are effectively free to sell using margin.

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. If doing pure option selling you should never get close to using margin. What you need to know.

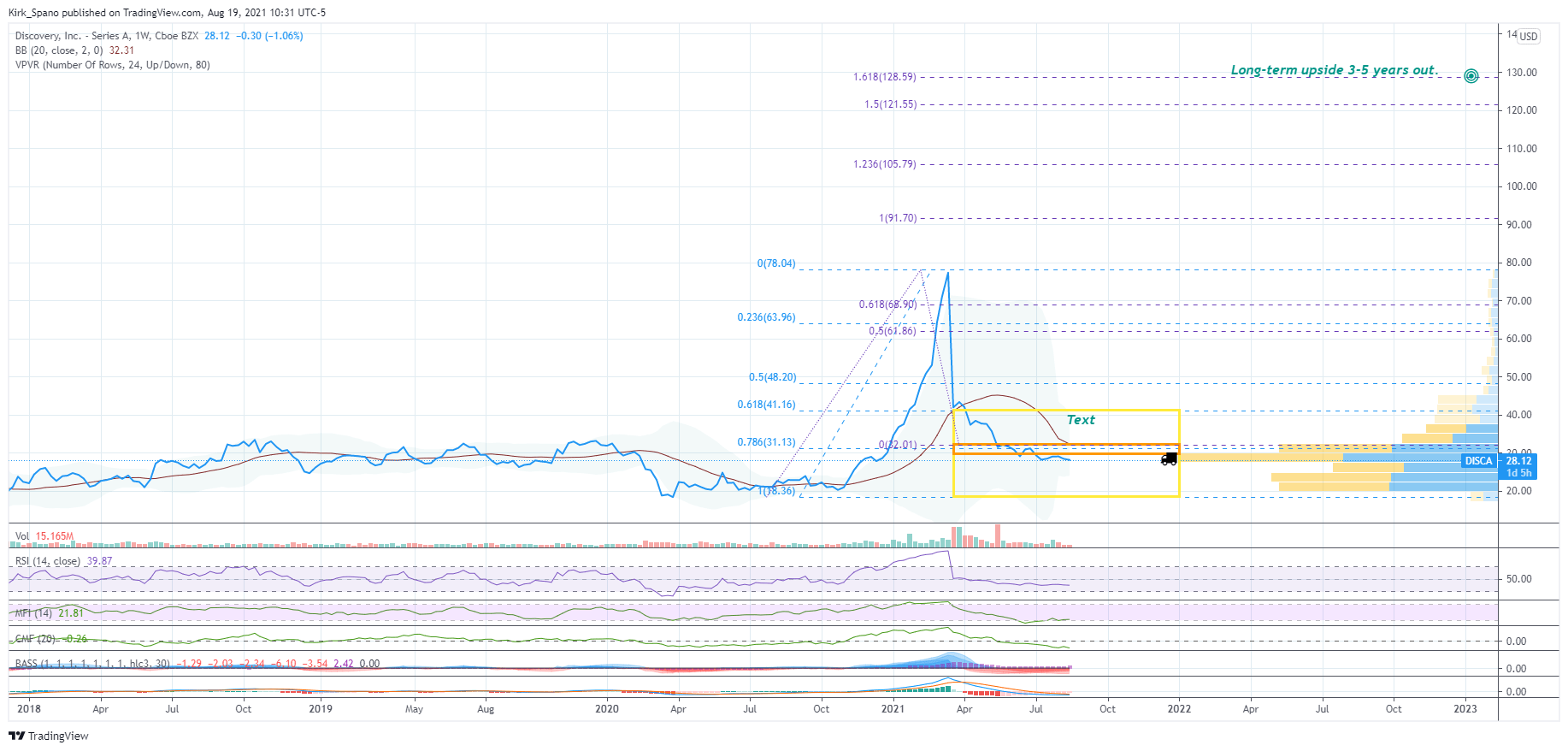

A Superior Option for Options Trading. With this information a trader would go into his or her brokerage account select a security and go to an options chain. Answer 1 of 20.

Margin requirements vary by option. If you are planning on making a big purchase but you think the item may go on sale in a week what would you do. Ad An easy way to get started with online trading.

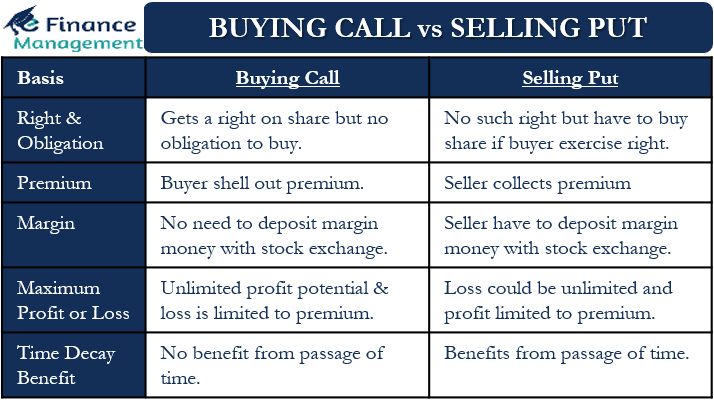

Initial 1 Maintenance 2. When you sell a option on margin you will only need to put up a of cash to cover the option. 100 Cost of the Option.

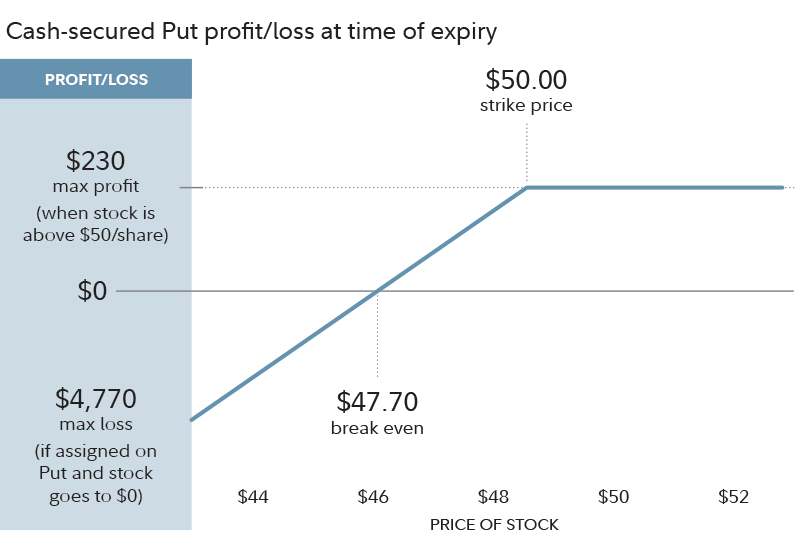

Trader wants to own 100 shares of YHOO if price goes down to 49. At 125contract if you close your position now its a 1K loss 125-25 10 100 1000 which is about 4 weeks of selling naked puts. In sum as an alternative to buying 100 shares for 27000 you can sell the put and lower your net cost to 220 a share or a total of 22000 for 100 shares if the price falls to.

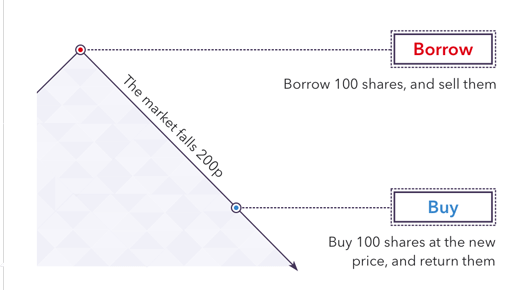

Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. Short puts are equivalent to covered calls. Sign up for the latest on how to invest in Nasdaq-100 Index Options.

The margin requirement for an uncovered put is the greatest of the following calculations times the. Short puts may be used as an alternative to placing buy limit orders. You could place a GTC limit order to buy 200 shares at 90 and wait to see if you buy the shares.

Selling puts on margin. YHOO current market price 4970. It bounces back to 53 on Tuesday but the.

Buy PutBuy Put and Buy. The expiration month. Answer 1 of 2.

Does webull allow you to buysell options on margin. Ad Turn Every Friday Into An Extra Payday Selling Options. Its not what the broker requires you to have for margin its what you need if you are assigned.

Posted by 6 months ago. Long Put Protective Put. The option margin is the cash or securities an investor must deposit in his account as collateral before writing options.

If you wrote 10 puts at a strike of 200 and you got assigned on them you need 200K of cold hard. Free Education No Hidden Fees and 247 Support. Naked Put Margin Requirement Applies when selling uncovered puts in a margin account.

Or you could sell two XYZ 90 puts at 225 and collect 450 2 X 225 X 100 450 on your. Make sure not to. To sell options on stocks the margin requirement is quite large because of the necessary cash that must remain in the account for option assignment in a worse-case.

If you get assigned and you dont have the margin to hold them then your broker will sell them in the after or pre market and credit you any gains but will also charge you interest on the extra. Both have an asymmetric riskreward you have a small potential profit and you bear all of the downside risk which is equal to the. Margin Accounts Cash Accounts.

100 Cost of the Option. Selling puts on margin. Once an option has been.

Most Profitable Option Trading Strategy Selling Puts Covered Calls Collar What Is The Most Pr Options Trading Strategies Option Trading Trading Strategies

How To Sell Calls And Puts Fidelity

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

Short Put Definition

Short Selling Explained What Is Shorting

2

When Market Ills Make The Economy Sick S P 500 Index Sick Economy

7 Cash Secured Puts To Sell Now Seeking Alpha

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

Most Profitable Option Trading Strategy Selling Puts Covered Calls Collar What Is The Most Pr Options Trading Strategies Option Trading Trading Strategies

Buying Call Vs Selling Put Meaning Example And Differences

Short Put Naked Uncovered Put Strategies The Options Playbook

Pin On Movie Clips

Selling Put Options How To Buy Stocks For Less

Short Call Naked Uncovered Call Strategies The Options Playbook

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

Cash Covered Puts Fidelity